🏦

Fixed Income Strategies

1. Yield Curve Trading (Interest Rate Risk)

Strategy: Exploiting changes in the shape and level of the yield curve through parallel shifts, twists (steepeners/flatteners), and butterfly trades.

Types of Trades:

- Parallel Shifts: Betting on overall interest rates rising or falling (duration plays)

- Twists: Betting on the spread between short-term and long-term rates changing

- Butterfly Trades: Isolating specific curve segments, e.g., betting the "belly" of the curve will underperform or outperform the "wings."

AI/ML Implementation

- Predictive Modeling: Time Series Analysis (ARIMA, LSTMs, Transformers) for forecasting yield curve points

- Factor Models: PCA + ML to identify key drivers of curve movements

- Regime Detection: Hidden Markov Models for identifying different yield curve regimes

- NLP: Analyze Fed communications to predict policy shifts

2. Credit Spread Trading (Credit Risk)

Strategy: Profiting from changes in creditworthiness through long/short credit positions and distressed debt investing.

Advanced Default Prediction

- ML models (Logistic Regression, SVM, Gradient Boosting, Neural Networks) for default probability

- NLP for early warning signals from filings and earnings calls

- Spread forecasting based on macro factors and company-specific news

3. Inflation Trading (Inflation Risk)

Strategy: Trading TIPS vs. nominal Treasuries based on inflation expectations and real yield discrepancies.

Inflation Nowcasting

- Combine alternative data (commodity prices, shipping rates) with RNNs

- Causal ML (DoubleML) to isolate Fed policy impact on breakevens

🏛️

Bank Preferred Stocks

1. Liquidity Crisis Trading

Strategy: Bank preferreds can gap down during liquidity crunches. AI detects early stress signals.

Graph Neural Network Implementation

- Build GNN analyzing interbank lending networks

- Correlate with Fed reverse repo volumes and Eurodollar futures

- Trigger hedges when GNN confidence >80%

2. Yield Capture Trading

Strategy: Focus on high-yield preferred stocks from fundamentally strong banks trading below their liquidation preference (typically $25) for capital appreciation and steady dividends. Prioritize cumulative preferred stocks to reduce the risk of missed dividend payments.

ML Application for Dividend Stability

- Random Forest/Gradient Boosting to predict dividend payment stability

- NLP analysis of earnings calls for management commitment

- ANN to predict the probability of a preferred stock trading above its liquidation preference in 12-24 months

3. Call Dates Trading

Strategy: Exploit call features and pricing behavior around call dates, especially for fixed-to-floating rate preferreds. If the "reset spread" is attractive relative to current market conditions, the preferred might be valuable even if not called. If the reset spread is unattractive, the bank is highly incentivized to call it. You can buy these below par ahead of a likely call.

Call Probability Models

- XGBoost/LSTM models trained on historical call decisions

- Input features: price vs. par, time to call, funding cost differentials

- Bank capital adequacy and reset rate analysis

🏢

REITs Strategies

1. Dividend Income Trading

Strategy: Invest in REITs with strong fundamentals, prioritizing high-quality properties and consistent dividend growth. Capture dividends by buying REITs before ex-dividend dates and selling shortly after, while managing downside risk.

- FFO Growth: Funds From Operations per share growth

- Debt-to-EBITDA: Target below 6x to avoid over-leverage

- NAV Discount: Buy REITs trading below Net Asset Value

Automated Analysis & Prediction of Dividend Cut Probability

- NLP: Parse SEC filings for key financial metrics and lease details

- Computer Vision: Analyze satellite imagery for property assessment

- Geospatial ML: Cluster regions by economic activity

- Dynamic NAV: ML-predicted cap rates for accurate valuation

2. Property Type Rotation

Strategy: Rotate into REIT sectors that benefit from macroeconomic conditions.

Sector Trend Analysis

- Time series models (ARIMA, Prophet, LSTMs) for economic forecasting

- NLP on industry reports and earnings calls for sentiment

- Hidden Markov Models for regime shift detection

3. ETF Arbitrage

Strategy: Exploit pricing inefficiencies between REIT ETFs and their underlying holdings.

Real-time Arbitrage Detection

- Monitor ETF NAV vs. market price discrepancies

- Ornstein-Uhlenbeck processes for convergence prediction

- High-frequency data analysis for short-term opportunities

📊

Equity Strategies

1. Value Investing

Quality Value (Buffett-Munger Style)

Focus on "wonderful companies at a fair price" with durable competitive advantages.

Moat Identification

- NLP: Analyze earnings calls and filings for brand strength indicators

- Network Analysis: Map supply chains for competitive positioning

- Pattern Recognition: Identify management behaviors correlating with value creation

Contrarian & Special Situations:

Investing in companies that are out of favor, misunderstood, undergoing significant corporate events (spin-offs, mergers, bankruptcies, restructurings), or in distressed industries.

Moat Identification

- Event Detection: NLP to scan news, regulatory filings (e.g., SEC filings for spin-offs, M&A), and legal documents for early signals of special situations

- Sentiment Shift Detection: Track sentiment around a company or industry. A sharp negative turn might signal a contrarian opportunity, while a gradual positive shift could indicate a turnaround is gaining traction

- Anomaly Detection: Identify companies whose stock price movements or financial metrics deviate significantly from peers or historical norms, potentially flagging an overlooked situation

Deep Value (NCAV/Net-Net Investing)

Finding companies trading below net current asset value with substantial margin of safety.

Enhanced NCAV Analysis

- Automated financial statement parsing and cleaning

- ML-enhanced liquidation value estimation

- Distress prediction models to avoid value traps

Piotroski F-Score (Bargains in Recovery)

This method focuses on identifying undervalued companies (often low P/B) that are showing signs of financial improvement. The F-Score is a 9-point system based on profitability, leverage, liquidity, and operating efficiency.

Enhanced NCAV Analysis

- Automated F-Score Calculation & Scoring: ML can automate the calculation of all nine Piotroski criteria across a vast universe of stocks, flagging those with improving scores

- Predictive F-Score Models: Instead of just calculating the current F-Score, ML models can be trained to predict future F-Scores based on historical trends and other leading indicators, identifying companies on an upward trajectory before the market fully recognizes it

- Factor Augmentation: ML can identify other fundamental factors (beyond Piotroski's original nine) that are strong predictors of recovery for undervalued firms, enhancing the F-Score's predictive power

2. Momentum Trading

Strategy: Identifying stocks with strong upward price movement and relative strength.

LSTM Implementation

- Train on 30-day price/volume sequences

- Include RSI, MACD, sentiment scores as features

- Enter trades when model predicts >70% momentum probability

3. Mean Reversion

Strategy: Capitalizing on asset price reversions to historical averages.

Enhanced Mean Reversion Signals

- ML models (SVM, Random Forest) for overbought/oversold detection

- Dynamic thresholds based on market volatility and regime

- False signal filtering using volume and sentiment data

📈

Futures Trading

1. Trend Following Trading

Strategy: Identifying and riding strong, sustained price movements by analyzing multiple timeframes and market breadth.

2. Breakout Trading

Strategy: Enters trades when prices break out of established patterns with volume and momentum confirmation.

3. Mean Reversion Trading

Strategy: Capitalizing on temporary deviations from historical average price, applied only in mean-reverting regimes.

⚙️

Options Strategies

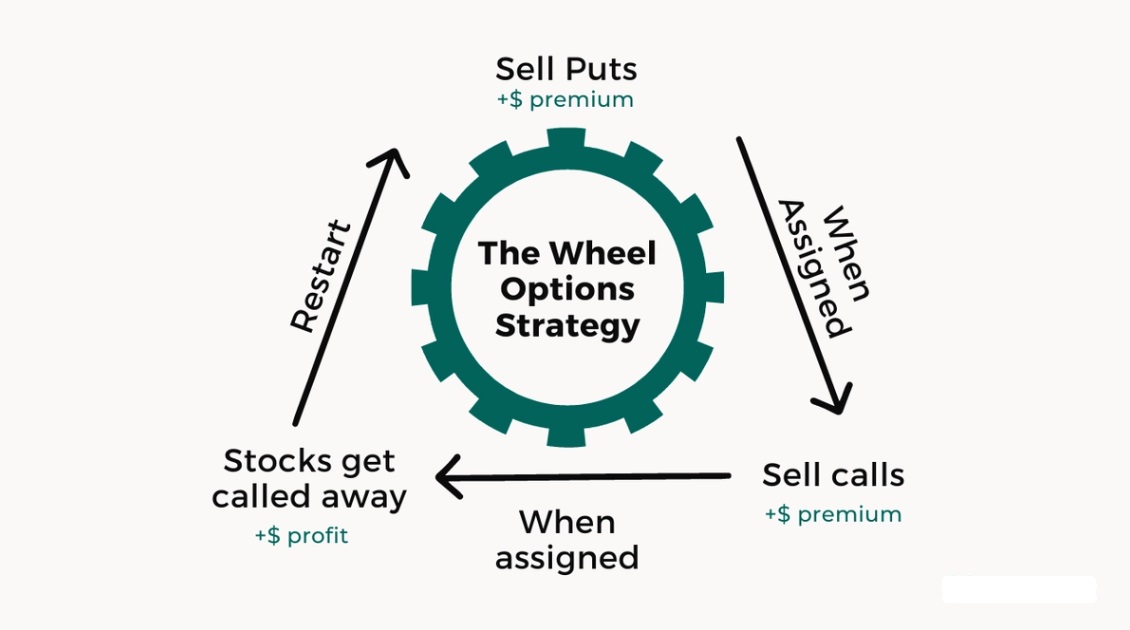

1. The Wheel Strategy

Strategy: Sell cash-secured puts, collect premium, and if assigned, sell covered calls until shares are called away.

Strike Optimization

AI analyzes implied volatility patterns, earnings calendars, and historical assignment probabilities to optimize strike selection and timing.

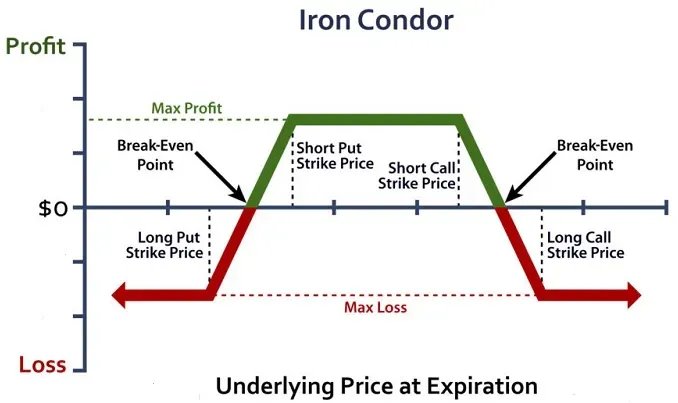

2. Iron Condors

Strategy: Defined-risk strategy combining bull put spread and bear call spread to profit from range-bound movement.

- Sell an OTM put and buy a further OTM put (bull put spread).

- Sell an OTM call and buy a further OTM call (bear call spread).

- Choose strikes where the stock is likely to stay between the sold strikes until expiration.

- Net credit from premiums is your max profit.

Range Prediction

- Volatility surface analysis for optimal entry points

- Support/resistance level identification

- Probability modeling for price staying within profit zone

3. Straddle/Strangle

Strategy: Buy a call and put with the same (straddle) or different (strangle) strike prices to profit from a significant price move in either direction

Volatility Forecasting Framework

- Ensemble Methods: LSTM + Random Forest + XGBoost for volatility prediction

- Greeks Optimization: Reinforcement learning for dynamic position sizing

- Sentiment Analysis: NLP on earnings calls and SEC filings

⚖️

Relative Value Arbitrage

Strategy: Identifying mispricings between similar securities

Types of Trades:

- On-the-Run vs. Off-the-Run Treasuries: Exploiting liquidity premiums

- Bank Preferred Tranches: Banks issue multiple preferred tranches with different coupons, resets, and structures. Pricing isn't always rational. Pairs trading between series (e.g., BAC-L vs BAC-M), exploiting liquidity premium, reset dates, etc.

- Equity Pairs Trading: Exploit price inefficiencies between related stocks (e.g., two tech companies with high correlation). Identify pairs of stocks with historical price correlation (e.g., >0.8). When their spread widens abnormally, short the overpriced stock and buy the underpriced one, betting on convergence

- Spread Trading: Involves simultaneously buying one futures contract and selling another related futures contract. This could be two different commodities (inter-market, e.g., crude oil and natural gas) or different expiration months of the same commodity (intra-market/calendar spread)

Risk/Reward:

Correlation breakdowns; high capital requirements for low returns

AI/ML Implementation Framework

Peer Group Analysis with ML

Use clustering algorithms (e.g., K-Means, DBSCAN) to identify truly comparable bonds. Then, build regression models (e.g., Random Forests, Neural Networks) to predict the "fair" spread for a bond based on its characteristics (duration, convexity, credit rating, sector, liquidity score, etc.) and its peers. Deviations signal RV opportunities.

Cointegration & Statistical Arbitrage

Use ML-enhanced statistical tests to find pairs or baskets of securities that historically move together. Trade deviations from this relationship.

Advanced Trading System

Use a GARCH model to estimate volatility and correlation dynamics. Train a reinforcement learning agent (e.g., DQN) to optimize entry/exit timing for pair trades. Enter trades when the spread exceeds a model-defined threshold (e.g., 2 standard deviations). Exit when convergence occurs. Automate via high-frequency trading platforms.

Dynamic Pair/Basket Discovery

Use clustering algorithms (K-Means, DBSCAN) or manifold learning (UMAP, t-SNE) on high-dimensional data (price, volume, fundamentals, alternative data) to find non-obvious, dynamically changing relationships and potential pairs/baskets.

Spread Modeling & Prediction

Use time-series models (ARIMA, GARCH) enhanced with ML features to model the spread; LSTMs or Transformers can be trained to predict spread convergence/divergence with higher accuracy

Optimal Hedge Ratio

ML regression models can determine dynamic hedge ratios that adapt to changing correlations and volatilities, superior to static ratios.

Regime-Specific StatArb

Train models to identify when StatArb strategies are likely to perform well (e.g., lower overall market volatility but sufficient individual stock dispersion).

🎇

Event-Driven Trading

🤝 M&A Trading

1. Announced Deals

Strategy: Capitalize on the spread between current market price and deal terms in formally announced M&A transactions.

Types of Deals

- All-Cash Deals: Buy target shares, profit from spread to cash offer price

- All-Stock Deals: Long target + short acquirer based on exchange ratio

- Mixed Deals: Balanced long/short positions matching deal structure

AI/ML Implementation - Deal Probability Assessment

- Gradient Boosting/Random Forest models for completion probability

- Feature engineering: deal size, premium, payment method, regulatory environment

- Neural networks for timeline prediction and spread volatility forecasting

- NLP analysis of expert commentary and regulatory filings

2. Rumored Deals

Strategy: Identify potential M&A targets before formal announcements using market intelligence and pattern recognition.

Key Success Factors

- Information Edge: Access to reliable market rumors and industry intelligence

- Fundamental Analysis: Identifying undervalued strategic targets

- Industry Trends: Recognizing consolidation patterns

- Activist Tracking: Monitor funds pushing for M&A activity

Anomaly Detection & Pattern Recognition

- Unsupervised ML for unusual trading activity detection

- Graph Neural Networks mapping executive/board relationships

- Supply chain analysis identifying strategic acquisition targets

- Patent/IP analysis using NLP for valuable technology assets

- Clustering algorithms for insider trading pattern detection

3. Thematic M&A Plays

Strategy: Identify industries ripe for consolidation due to technological disruption, regulatory changes, or economic pressures. Then, strategically pick potential acquirers and targets within that theme. When one company in a sector gets acquired, others often become targets. This involves identifying sector-wide consolidation trends and positioning across multiple potential targets.

AI-Driven Theme Identification

- NLP scanning of research reports, news, patents, earnings calls

- Company scoring within themes for acquisition likelihood

- Technology trend analysis (AI in Healthcare, Renewable Energy)

- Competitive landscape mapping and strategic positioning assessment

🌍 Macro Events Trading

Macroeconomic Event Strategy

Strategy: Position portfolios based on anticipated macroeconomic trends, policy changes, and major economic events.

Advanced Macro ML Implementation

- Nowcasting economic indicators using high-frequency alternative data

- Credit card transactions, shipping data, satellite imagery analysis

- Historical event impact analysis for future event prediction

- Proprietary sentiment indices from news and social media

- NLP categorization of event types and market impact assessment

🏢 Corporate Actions Trading

1. Bank Preferred Stock Actions

Strategy: Exploit price inefficiencies from new preferred issuances, redemptions, and credit rating changes.

Execution Framework

- Monitor bank earnings reports and SEC Form 8-K filings

- Track credit rating updates from S&P, Moody's, Fitch

- Identify mispriced preferreds trading below par post-event

- Use options strategies for enhanced returns and risk management

NLP & Sentiment Analysis Implementation

- BERT-based models for event classification (positive/negative/neutral)

- K-means clustering for mispriced securities identification

- Real-time monitoring of news feeds, SEC filings, social media

- Automated alerts for significant corporate actions

2. REIT Event Trading

Strategy: Capitalize on REIT-specific events like acquisitions, property sales, and major leasing agreements.

REIT-Specific ML Applications

- Event prediction models based on historical patterns

- Real-time news processing with FinBERT sentiment analysis

- Alternative data integration (foot traffic for retail REITs)

- Earnings surprise prediction using pre-announcement indicators

- Pattern recognition in high-frequency trading data around events

3. Special Situations

Strategy: Capitalize on various corporate restructuring events and distressed opportunities.

Types of Events

Spin-offs/Divestitures: Profiting from the separation of a business unit.

Tender Offers: When an acquirer offers to buy shares directly from shareholders at a premium.

Liquidations/Bankruptcies: Distressed situations where assets are being sold off.

Rights Issues/Open Offers: Opportunities arising from new share issuances.